Navigating ASC 606 Compliance in Sales Commission Accounting

After the adoption of the new rules under ASC 606, a lot has changed in the accounting of sales commissions. If anything, the most significant emphasis of the standard underlines the importance of the methodical approach in relation to recognition of commission expenses which aligns the efforts with the income they generate. Importantly, such changes need to be understood and implemented so that compliance remains and is transparent.

Key Things to Note When Compliant with ASC 606 about Sales Commissions:

- Amortization of Sales Commissions: ASC 606 capitalizes sales commissions. The commissions should be expensed as and when it is reasonably expected to be incurred. They should be amortized for the period that they are expected to benefit from—normally the customer life cycle. Commission costs should be considered as assets, and the expenses should be recognized in a systematic manner over time to be associated with revenues.

- More Advanced Revenue Recognition: The standard lays down a five-step approach for recognizing revenue, and this will affect the accounting for sales commissions. Revenue is now recognized at the point in time when customers take control of a service or product, something that is changing both the timing and measurement with respect to commission expense recognition by companies.

- Financial Reporting Adjustments: ASC 606 alignment gives a more consistent financial report to the stakeholders in that it smoothes out the recognition of expenses, avoiding the occurrence of big one-off costs that can otherwise mislead stakeholders on the operational performance of a company.

- Rigorous Compliance Requirements: Being in compliance with ASC 606 is not a choice; it is a requirement of the regulation.

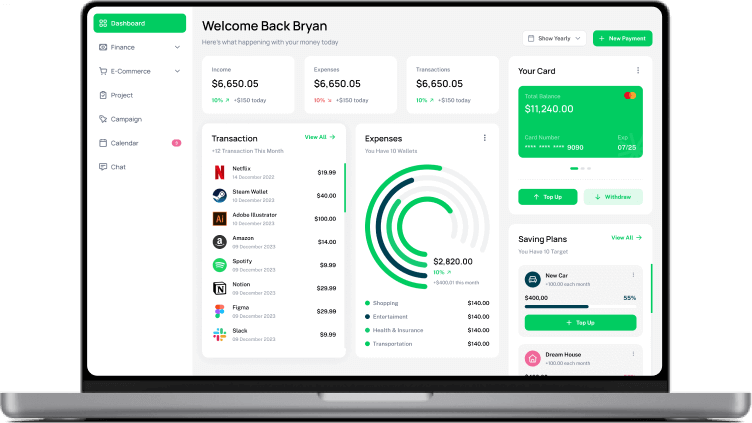

- Use of Technology to Drive Compliance: Most companies combat the challenges that come under ASC 606 through the use of various accounting software. Through using such systems, the companies are able to automate commissions calculation, tracking, and reporting process and avoid errors while assuring compliance through detailed record-keeping and analysis.

Adopting these practices means the companies remain compliant with not only ASC 606 but also embrace this compliance for enriching their financial and strategic decision-making processes.

Implementing Technology to Manage Sales Compensation Compliance with ASC 606

Great technological solutions do a pretty good job at incorporating the managing complexities related to ASC 606 compliance for sales compensation. Knowledge and the right implementation of technology should help ensure accuracy and transparency in revenue recognition and commission calculations under the new standards.

Key Benefits of Technology in Managing ASC 606 Compliance:

- Automated Calculations: The leading-edge software automatically recognizes and calculates revenues and commissions, thereby greatly reducing the manual processing of errors, apart from ensuring adherence to the guidelines of ASC 606.

- Real-Time Tracking: Sales and commission can be tracked at real-time; hence, adjustments can be instantly made through the system resulting from changes in sales transactions or in terms of the contract.

- Comprehensive reporting: Technology has provided sufficiently detailed audit trails and compliance checks. It offers a comprehensive overview of minute details in revenue recognition and accompanying commissions over the term of the contract.

- Existing System Integration: Suitable solutions can be integrated with existing systems, be they CRM or ERP, so all the financial data is synchronized and correctly represented across the platforms.

- Scalability and Flexibility: Businesses expand over time, and the technology accommodates their needs as they continue to grow and change. As the business becomes more complex in terms of structure and sales compensation, the application cannot compromise

This kind of technology will automate the procedure for the set-up and administration of sales commissions in compliance with ASC 606 and, in its turn, will provide an enhanced approach to strategic decision-making by visible sales performance and financial outcomes.

Key Strategies for ASC 606/IFRS Compliance:

- Contract Management: Proper contract management is the key element right from the start under ASC 606/IFRS 15; these regulations require a keen assessment of the terms of the contract in order to identify performance obligations and transaction prices. Companies need to have robust systems that can handle these complexities effectively.

- Performance Obligations: Knowing when and how to determine and explain the performance obligations in contracts is the most important area. Each performance obligation must be measured to realize when the revenue should be recognized and it directly affects how sales commissions are measured and paid.

- Revenue Recognition: Revenue recognition has been a big emphasis under ASC 606/IFRS 15. Companies are supposed to have systems to properly identify instances of the transfer of control of goods or services to the customer—key points that drive commission payments to employees.

- Variable Consideration : Variable consideration is one of the novelties of the new standard. Normally, it includes discounts, incentives, or bonuses. Such factors should be estimated as part of the transaction price. As a result, commissions should be calculated to consider the estimation of variable consideration. This makes it more complicated but, at the same time, more transparent.

- Technological Integration: The compliance with ASC 606/IFRS 15 shall be managed with the leverage of technology. Advanced software solutions shall automate and streamline calculations, tracking of changes, and thereby ensure accuracy in reporting and compliance, which, in turn, reduces errors and saves time.

Such adherence to guidelines would therefore ensure that the sales compensation practices of firms meet the new standards of revenue recognition while, at the same time, ensuring that they are in line with strategic business goals.

Future Trends in Sales Compensation Management and Technology Integration Post-ASC 606

Regulatory changes brought about by technological advancement, such as ASC 606, have been the driving force behind changes in how sales compensation management has evolved. Increasingly, companies are using technology not just to become compliant with these regulations but also to devise methods that promote an overall better strategy on sales performance management.

Emerging Trends in Sales Compensation

- Increased Automation: As technology continues to advance, sales compensation calculations and processes continue to be automated. More automation not only eases compliance with complex regulations such as ASC 606 but also provides higher levels of accuracy and efficiency while reducing risks related to errors resulting from manual processing.

- Advanced Analytics and Forecasting: The addition of advanced analytics tools in most sales applications allows a business to predict future performance and come up with datadriven decisions for the sales strategy and compensation plans. In this regard, this trend holds good to accord sales incentives in line with business goals under the imposed conditions of ASC 606.

- Greater Transparency and Accessibility: This is another area in which technology is applied to make the sales compensation process more transparent. Real-time visibility over data about compensation, afforded by the platforms, feeds trust amid sales teams so all team members understand without much ambiguity what they are being incentivized for and how the incentives are shared.

- Integration with CRM and ERP Systems : The tools for compensation management must be able to integrate easily with the existing CRM and ERP systems. It helps synchronize the data from the multiple business functions, thus realizing a holistic view of business operations and financials as per ASC 606.

- Sales Incentive Personalization – A recent trend pertaining to this is the inclusion of the individual performance metrics in the sales incentives. Personalized incentives motivate the sales staff and therefore help the company better manage compensation expenses as per revenue recognition standards.

Embracing such trends would allow following ASC 606 and would also act as a way to modernize and upgrade the sales compensation frameworks of companies. The forward-looking approach would further ensure that the business does not lose to competition and is able to keep it highly adaptive to this dynamically changing market landscape.

Conclusion

Compensation management in sales is rapidly changing because of various technological advancements and regulatory changes, such as ASC 606. As business aligns to this kind of change, infusion of advanced technologies has become part of the core business processes. These technologies not only help the enterprise to line up with complex regulations but also enhance general business competency and strategic decision-making. As the sales compensation management field matures from automation and advanced analytics into increased transparency and personal incentives, the future will be more data-driven and responsive. Such developments hold out the promise of enabling businesses to align their sales strategy with company-wide objectives, through the boosting of growth and profitability in a compliant and efficient manner. An overview ahead clearly envisions the function of technology in sales compensation management as it becomes all the more key with companies navigating through the complications of modern business landscapes. Companies that proactively embrace these changes and innovations will be well-positioned to lead in efficiency and effectiveness, setting new standards for industry best practices.